In the digital age, where government services and financial transactions are increasingly becoming paperless, linking your PAN (Permanent Account Number) with Aadhaar has become a crucial step. This linkage not only streamlines your financial dealings but also ensures compliance with regulatory requirements. If you’re wondering how to navigate through this process seamlessly, fret not! In this human-friendly guide, we’ll walk you through the steps to link your PAN with Aadhaar effortlessly.

UNDERSTANDIN PAN &AADHAR:

Before we delve into the linking process, let’s briefly understand what PAN and Aadhaar are:

- PAN: Issued by the Income Tax Department, PAN is a unique identification number assigned to individuals and entities for tracking financial transactions, such as tax payments, investments, and purchases exceeding certain thresholds.

- Aadhaar: Issued by the Unique Identification Authority of India (UIDAI), Aadhaar is a 12-digit unique identification number that serves as proof of identity and address for Indian residents. It is widely used for availing various government services and subsidies.

Why Link PAN with Aadhaar?

Linking your PAN with Aadhaar offers several benefits:

- Streamlined Financial Transactions: Once linked, your PAN and Aadhaar details are authenticated, simplifying financial transactions and reducing the need for separate identity verification.

- Prevention of Tax Evasion: Linking PAN with Aadhaar helps the government track and curb tax evasion by ensuring that individuals do not possess multiple PAN cards.

- Easy Income Tax Filing: The linkage facilitates seamless income tax filing and processing, enabling quick verification of tax returns.

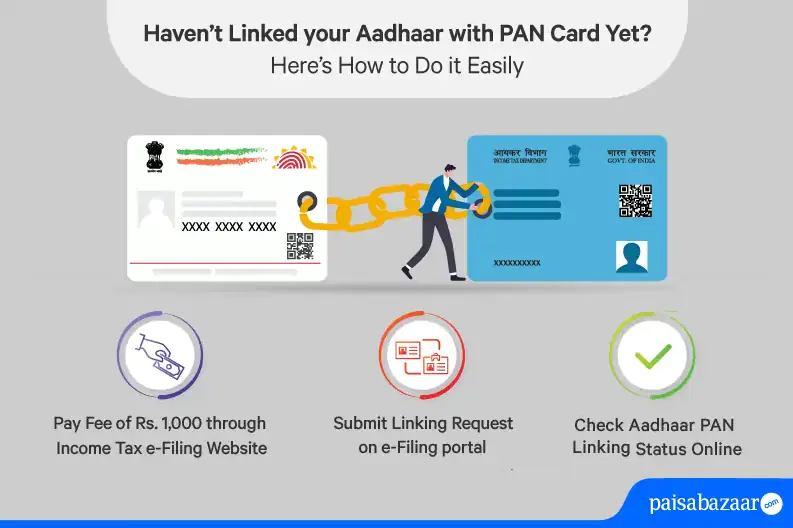

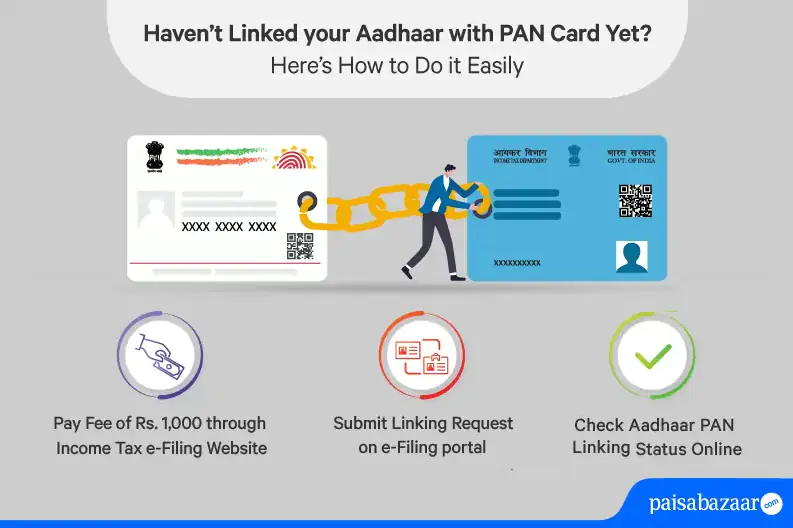

Step-by-Step Guide to Linking PAN with Aadhaar

Now, let’s dive into the process of linking your PAN with Aadhaar:

- Visit the Official Portal: Start by visiting the official Income Tax Department website or the UIDAI portal.

- Navigate to Link Aadhaar Section: Look for the ‘Link Aadhaar’ or ‘Link PAN with Aadhaar’ section on the respective portals. You may find this under the ‘Services’ or ‘My Account’ tab.

- Enter Details: Provide the required details such as your PAN number, Aadhaar number, and other relevant information as prompted.

- Verify Details: Double-check the details entered to ensure accuracy and avoid discrepancies.

- Authentication: Once you’ve entered the details, the system will authenticate the information provided with the respective databases.

- OTP Verification: In some cases, OTP (One-Time Password) verification may be required for authentication. Ensure that your registered mobile number with Aadhaar is active to receive the OTP.

- Confirmation: Upon successful verification, you’ll receive a confirmation message indicating that your PAN has been linked with Aadhaar.

Final Thoughts

Linking your PAN with Aadhaar is a simple yet significant step towards ensuring financial transparency and compliance. By following the steps outlined in this guide, you can complete the process with ease and unlock the benefits of seamless financial transactions and tax compliance. So, don’t delay – take advantage of this convenient linkage today and embark on a hassle-free journey towards financial well-being!