Introduction:

Investing can feel like a vast and mysterious jungle, but fear not – it’s a jungle that can be navigated with the right knowledge and approach. In this guide, we’ll explore the best ways to invest in a human-friendly tone, focusing on making informed decisions that align with your goals, values, and financial well-being.

Investment Types:

- Set Clear Goals: Before you embark on your investment journey, take a moment to define your goals. Are you saving for a dream vacation, a home, or your children’s education? Understanding your objectives will help shape your investment strategy.

- Start with Education: Knowledge is power in the world of investing. Take the time to educate yourself on different investment options, risk profiles, and market trends. There are numerous resources, both online and offline, that can help you build a solid foundation of understanding.

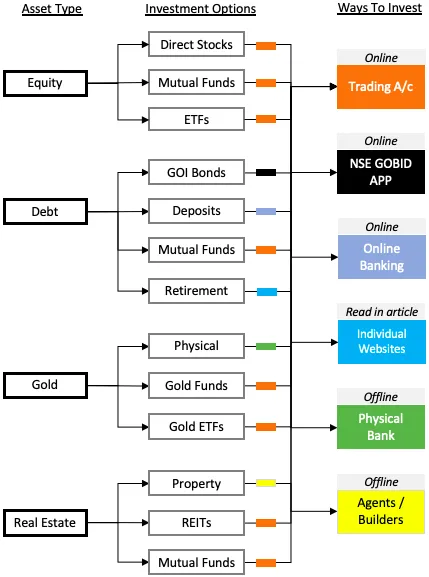

- Diversify Your Portfolio: Just as a healthy diet involves a variety of foods, a well-balanced investment portfolio should include a mix of assets. Diversification helps spread risk and can enhance long-term returns. Consider a mix of stocks, bonds, real estate, and other investment vehicles.

- Invest for the Long Term: Successful investing is often a marathon, not a sprint. Instead of chasing short-term gains, focus on building a robust portfolio that can withstand market fluctuations over time. This approach is especially effective for retirement planning.

- Emergency Fund First: Before diving into the investment pool, ensure you have a solid emergency fund. This financial safety net can cover unexpected expenses and prevent you from tapping into your investments during challenging times.

- Understand Risk Tolerance: Assess your own risk tolerance honestly. Some people can handle the rollercoaster ride of the stock market, while others prefer a smoother journey with lower-risk investments. Your comfort level with risk should guide your investment decisions.

- Stay Mindful of Fees: Be aware of the fees associated with different investment options. High fees can eat into your returns over time. Look for low-cost investment vehicles and platforms that align with your financial goals.

- Regularly Review and Adjust: Life is dynamic, and so should be your investment strategy. Regularly review your portfolio to ensure it still aligns with your goals and risk tolerance. Adjustments may be needed as your financial situation and market conditions change.

- Seek Professional Advice When Necessary: If the investment jungle gets too dense, don’t hesitate to seek advice from a financial advisor. A professional can provide personalized guidance based on your unique circumstances.

- Stay Calm During Market Volatility: Market ups and downs are inevitable, but it’s crucial to remain calm. Avoid making impulsive decisions based on short-term fluctuations. A well-thought-out, long-term strategy can weather the storm.

Conclusion:

Investing is not reserved for financial experts; it’s a journey that anyone can embark on with the right mindset and knowledge. By setting clear goals, diversifying your portfolio, and staying informed, you can navigate the investment jungle and work towards a financially secure future. Remember, the key is to invest smartly, stay patient, and enjoy the journey!